The decision to impose sanctions on major Russian oil producers could have caused a sharp rise in global crude prices, potentially pushing rates beyond 80 dollars per barrel and affecting fuel costs in the United States before next year’s midterm elections.

However, the 69 billion dollar oil trade between India and Russia may not be coming to an immediate halt. Recent sanctions by Washington on Rosneft and Lukoil, two of Russia’s largest energy companies, and the European Union’s additional measures on Russian oil and gas, still leave gaps that allow the flow of crude to continue.

Analysts note that while the United States has targeted Russian firms, both Washington and Brussels have refrained from directly sanctioning Russian oil itself. This means Russian crude can still move freely in the international market. Refining officials in India have stated that local refiners are not violating any domestic or international laws when purchasing Russian oil, provided the sellers are not under direct sanctions.

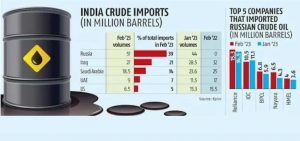

Yet, short-term disruptions are expected. Orders for December deliveries may face complications as Russia scrambles to adjust to the new restrictions. About 70 percent of India’s Russian oil imports this year came from Rosneft and Lukoil, while another 8 percent came from Surgutneftegaz, which had already been sanctioned by the US earlier.

Energy expert Tatiana Mitrova from Columbia University’s Center on Global Energy Policy remarked that the real impact of these sanctions will depend on how strictly they are enforced rather than the headlines they make. The sanctions on Rosneft and Lukoil, announced in October 2025, could influence the flow of nearly five million barrels of oil per day from Russia. Rosneft alone supplied India with roughly 910,000 barrels daily, nearly half of India’s total imports from Russia this year.

This marks the second time since the Ukraine conflict began in 2022 that the United States has penalized Russian producers without banning the commodity itself. Despite earlier sanctions, Surgutneftegaz continued shipping to India, highlighting the flexibility within the sanctions system.

Meanwhile, the European Union sanctioned Russian liquefied natural gas but avoided penalizing Rosneft and Lukoil due to domestic energy dependencies. Experts such as George Voloshin from ACAMS pointed out that while Lukoil’s UAE-based trading arm was sanctioned, its Swiss unit remained untouched, revealing another gap in the restrictions.

Indian officials maintain that the country observes only United Nations sanctions and not unilateral measures imposed by individual nations. They clarify that since Russian oil itself is not under direct sanction, Indian companies are legally allowed to continue purchases.

According to Indian energy analyst Narendra Taneja, Western nations have deliberately avoided sanctioning Russian crude to prevent severe disruptions in global supply. He noted that oil prices have risen only slightly to around 65 dollars per barrel, showing that markets expect Russian crude to remain accessible.

Vandana Hari, an energy expert from Singapore, explained that a full-scale ban on Russian oil would have pushed global prices far higher, severely affecting US fuel costs. Other analysts, such as Sumit Ritolia from Kpler, agreed that Washington’s decision reflects a strategy to limit impact on the global economy while maintaining pressure on Russia.

Russian oil makes up nearly 6 percent of global supply, and eliminating it from trade would cause significant imbalances. Experts expect that while some disruption will occur in December and January, Moscow will soon find alternative trading routes through intermediaries.

According to Kpler data, tankers carrying Russian crude accounted for 3.6 million barrels per day this year, with Rosneft and Lukoil making up nearly half of that volume. The rest came from unverified sources, reflecting growing opacity in the trade as Russia works around restrictions.

The United States Treasury has allowed financial transactions with Rosneft and Lukoil until late November, after which a temporary decline in shipments is expected. However, once new intermediaries take over, supply levels are likely to stabilize.

Large international trading houses such as Glencore and Vitol have avoided Russian crude due to sanction risks, leaving smaller Dubai- and Hong Kong-based firms to handle the trade. Some of the key players include 2 Rivers DMCC, Amur Investments, Nexus Trading, and Coral Energy.

Should Russian crude disappear from the global market, prices would face upward pressure. The premium for Middle Eastern grades, which substitute Russian Urals crude, has already tripled compared to pre-sanction levels. Russia’s crude production reached 10.2 million barrels per day last year, representing around 12 percent of global output, with exports totaling 7 million barrels daily.

China, India, and Turkey remain the largest buyers of Russian oil, each preferring different crude varieties. Indian refiners favor the cheaper Urals blend, while China’s independent refiners prefer the lighter ESPO crude.

Indian state refiners such as Indian Oil and Bharat Petroleum are exploring ways to continue imports through non-sanctioned entities, expecting larger discounts. Private firms like Reliance Industries, however, may face difficulties under a long-term contract with Rosneft due to potential secondary sanctions on financial institutions involved in such transactions.

Reliance has stated that it will comply with international regulations while maintaining supplier relationships. The future of India-Russia oil trade will depend on multiple factors, including Russia’s response to Western diplomatic moves, enforcement of sanctions, and the size of discounts Moscow offers.

Experts predict that Russian oil discounts could expand by another three to eight dollars per barrel, and despite new measures, the actual impact on trade may remain limited as alternative networks emerge to keep Russian oil in circulation.

Discussion about this post